Prime cost method depreciation calculator

Business vehicle depreciation is a Prime. The two methods can be understood with an example.

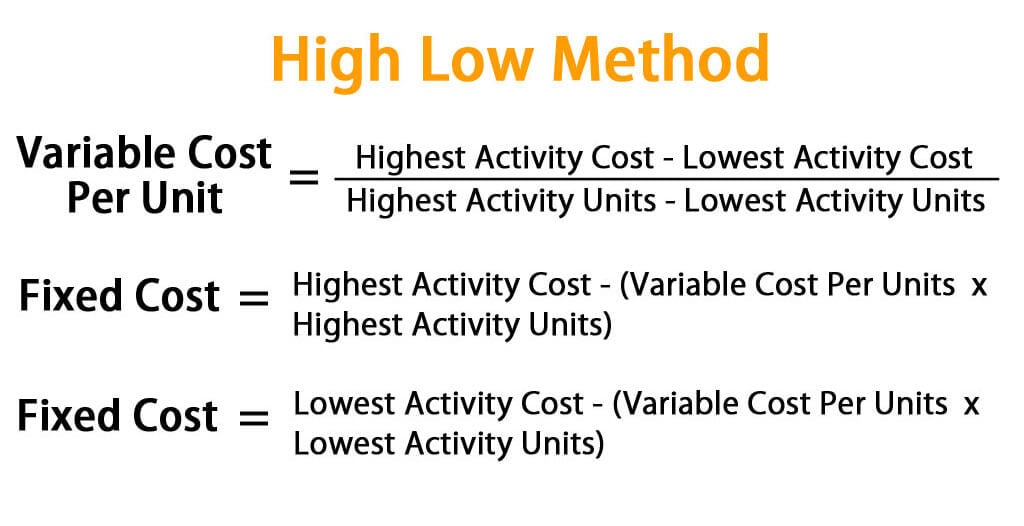

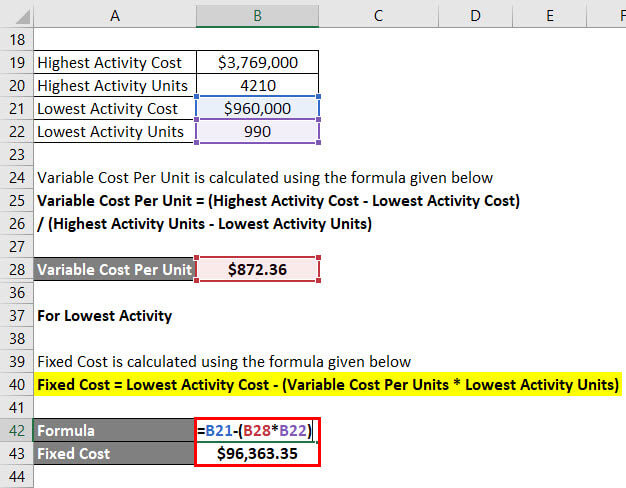

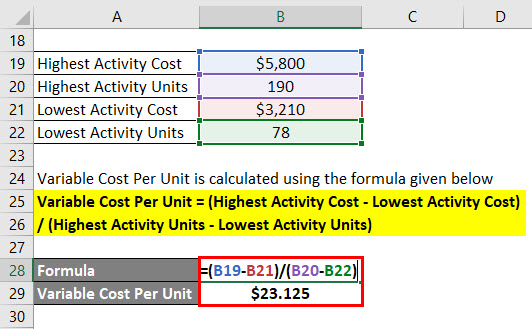

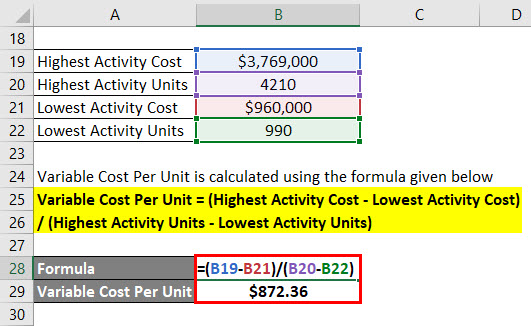

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Since this method returns greater deductions in the later years of the depreciation schedule it suits investors looking to maximise their depreciation claim in later years.

. The formula for prime cost depreciation method. Asset Cost Salvage Value Useful Life Depreciation Per Year. We can calculate prime cost when we know the direct material cost and direct labor cost.

The basic formula for calculating your annual depreciation costs using the straight-line method is. The prime cost calculates the use of raw. Last year depreciation 12 - M.

The straight line calculation as the name suggests is a straight line drop in asset value. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. It provides a couple different methods of depreciation.

If the cost of an. Prime cost method. Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its.

This rate is based off the. Formula to calculate prime cost is given by. The prime cost method Diminishing value Under the diminishing value method the deduction is calculated as a percentage of the balance you have left to deduct This method.

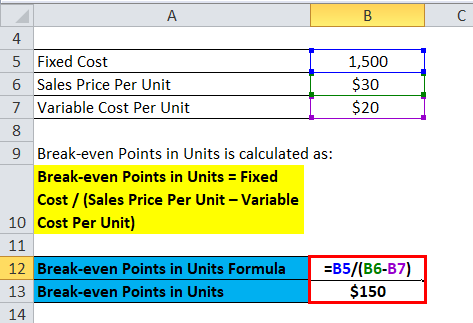

Calculate Prime Cost Depreciation 80000 x 365 365 x 20 16000 If the asset was acquired mid-way through the year you would update the days held value. The prime cost depreciation method calculates a decline in the value of an asset through its effective life at a fixed rate every year. Prime Cost Depreciation Method This depreciation method calculates the decrease in values of an asset over its effective life at a fixed rate per year using the following.

In the below online prime cost calculator enter the direct. First one can choose the straight line method of. The calculator uses both the diminishing value and prime cost method to give you an estimate of what you can claim on a depreciating asset construction costs or capital allowance.

Prime cost refers to a manufactured products costs which are calculated to ensure the best profit margin for a company. Under this method the real cost of using an asset is the depreciation and Example 2. The depreciation of an asset is spread evenly across the life.

This depreciation calculator is for calculating the depreciation schedule of an asset. Lets take a piece of. The prime cost method also known as the straight line method of depreciation calculates deductions using a uniform rate.

Examples of Prime Cost and Diminishing Value Depreciation Method. If n 3 years S S 64000 and C 1000000 calculate rate of How to calculate depreciation.

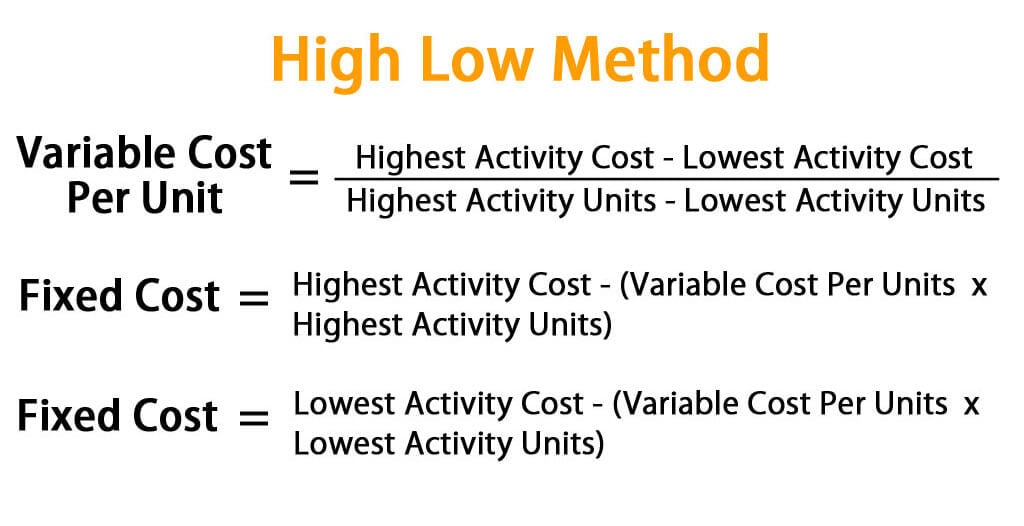

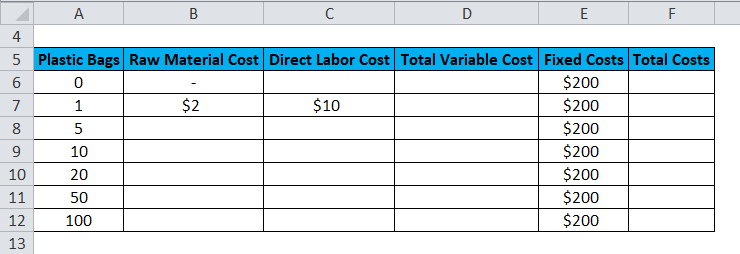

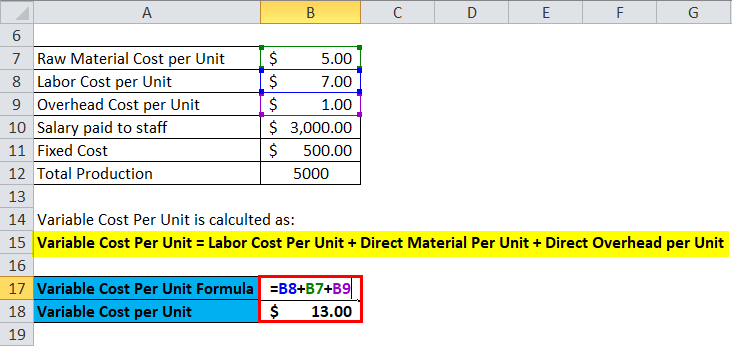

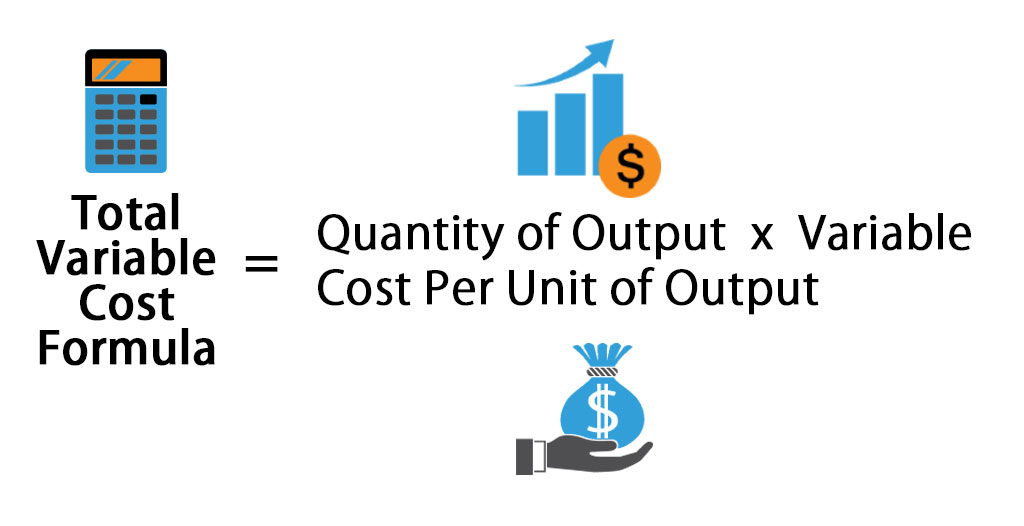

Variable Costing Formula Calculator Excel Template

Variable Costing Formula Calculator Excel Template

Variable Costing Formula Calculator Excel Template

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

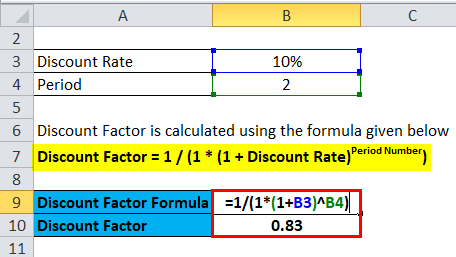

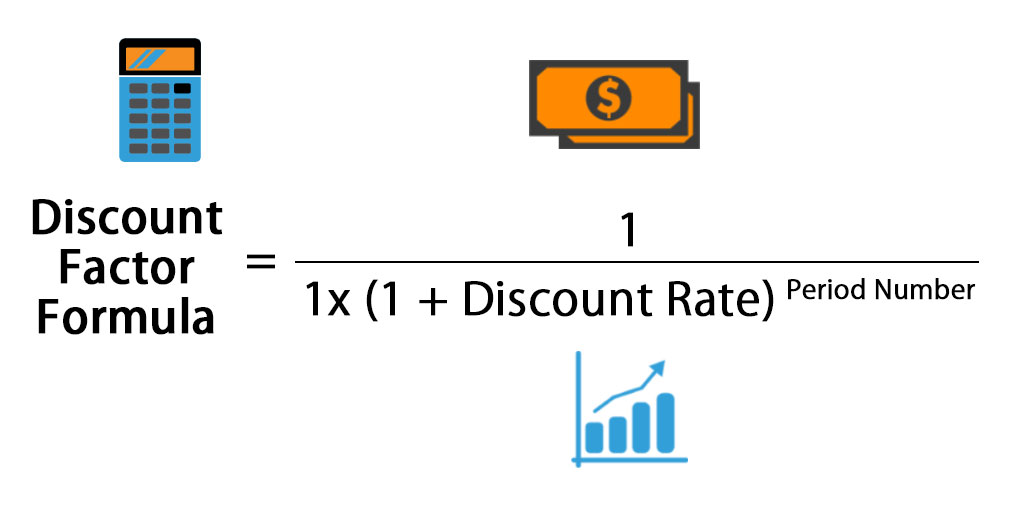

Discount Factor Formula Calculator Excel Template

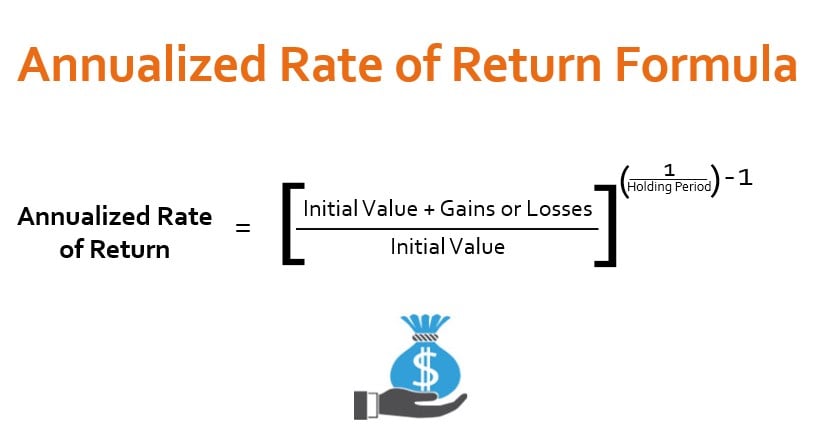

Annualized Rate Of Return Formula Calculator Example Excel Template

What Is Prime Cost

Variable Costing Formula Calculator Excel Template

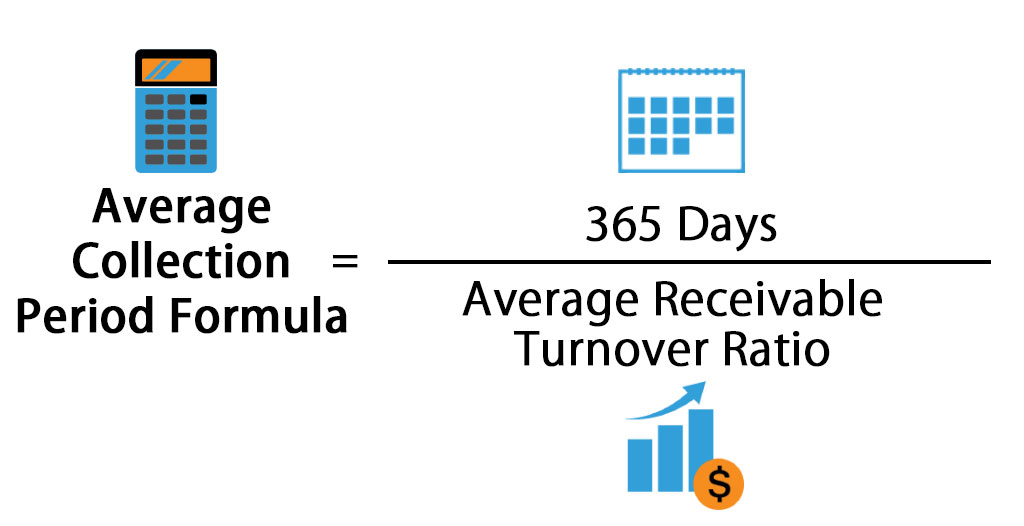

Average Collection Period Formula Calculator Excel Template

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

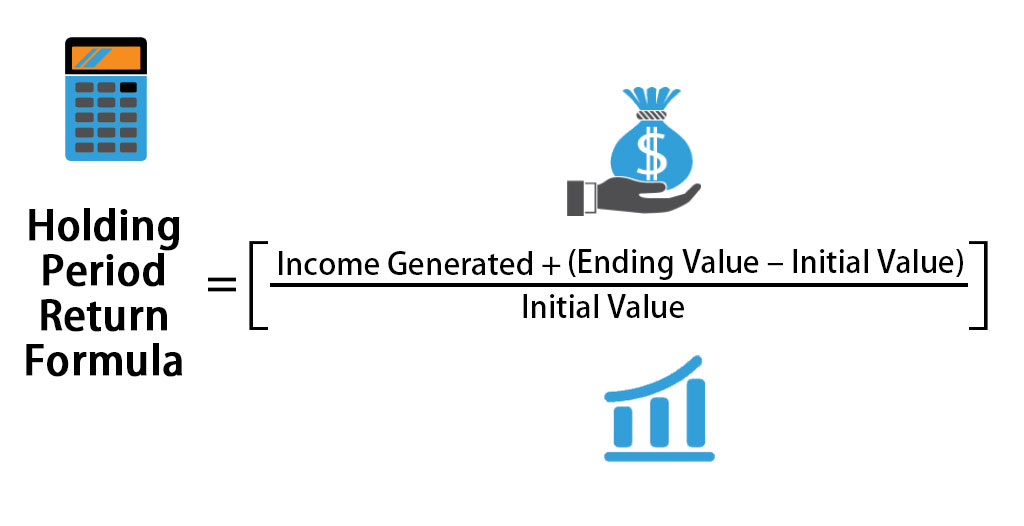

Holding Period Return Formula Calculator Excel Template

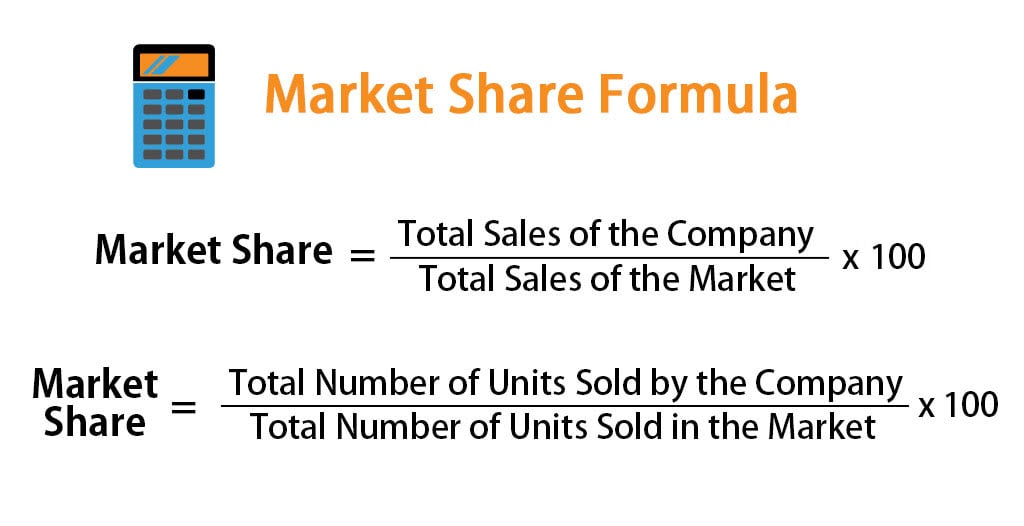

Market Share Formula Calculator Examples With Excel Template

Free Cash Flow Formula Calculator Excel Template

Prime Cost Straight Line And Diminishing Value Methods Australian Taxation Office

Variable Costing Formula Calculator Excel Template

Discount Factor Formula Calculator Excel Template